TheOnchainEra

The Onchain Era

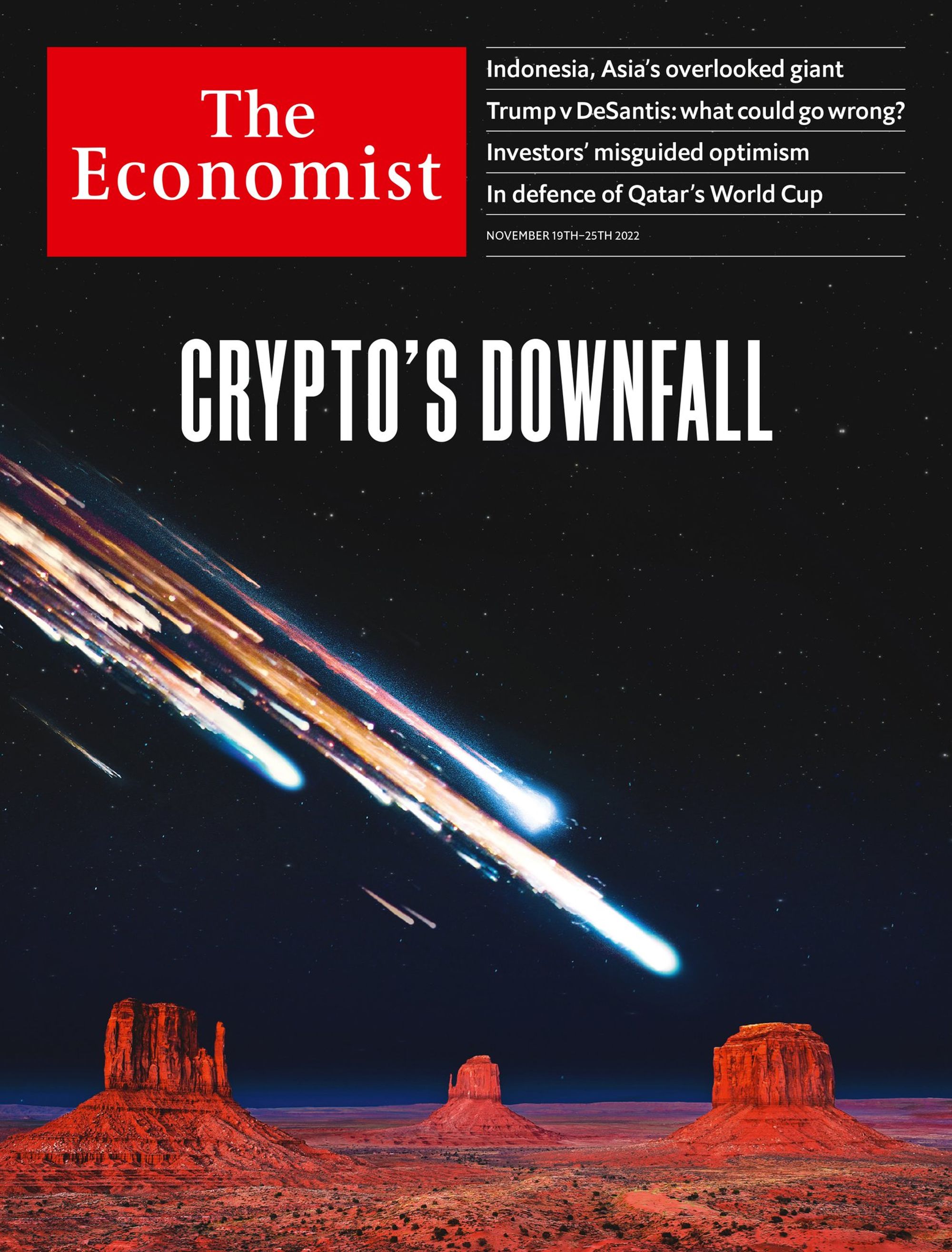

Crypto is dead and few will mourn it. Now that the bubble has burst, the truly revolutionary work can begin

This year people watched the crypto world burn.

Outside those who tragically lost significant sums of money or whose Twitter pics got laser-eyed during the pandemic, crypto’s demise has been mourned by virtually no one. Its excesses have been an expensive, absurd, living, and breathing example of the fraud and empty money that’s symbolic of much of recent human history.

This period and euphoria could not last forever, and they didn’t. The Crypto Era is now coming to a close. Not because of SBF (though he did contribute), but from a culmination of many things with which we’re all familiar: cryptocurrency’s wild price fluctuations that make it practically unusable as a functional currency; off-shore tax schemes that evade regulation and financial controls; the securitization of everything; and much, much more.

The end of the Crypto Era was marked with another big story: the merge of the new, proof-of-stake version of Ethereum. This evolution created cheaper, less energy-demanding infrastructure and a new chapter in blockchain history: the Onchain Era.

The Crypto Era

The Crypto Era began with the launch of the Bitcoin whitepaper in 2008. It ended with the switch of Ethereum to a proof-of-stake validation model in September 2022.

The Crypto Era was defined by the creation of the technical vision of the blockchain and its first applications: cryptocurrencies, most notably Bitcoin and Ethereum.

The benefits of the Crypto Era were the invention of blockchains and the proliferation of the ideas that underpin them; the establishment of new forms of digital value; and the energy it directed towards reimagining institutions and financial norms.

The defining product of the Crypto Era was crypto itself—cryptocurrencies, crypto-infrastructure, crypto-investments, crypto-organizations, and, at the end, derivatives of the infrastructure like NFTs.

The drawbacks of the Crypto Era were human greed amplified by crypto—Ponzi schemes, fraudsters, hucksters, and endless speculation manufacturing and inflating assets at a mass scale, sometimes using illegal means.

Crypto’s eventual downfall was mourned by few outside those directly affected, and cheered by almost everyone else. Crypto Era: 2008 - 2022 (R.I.P.).

The Onchain Era

In September 2022, Ethereum successfully switched to a proof-of-stake model, dramatically reducing its energy and financial costs, making Ethereum closer to a practically usable (rather than theoretical) world computer for the first time. With the merge, the Onchain Era began.

The Onchain Era will be defined as the period during which much of the world’s creative and cultural output, shared histories, and information infrastructure will become established, stored, and accessed onchain.

The benefit of the Onchain Era will be the way it empowers individual users and user-groups to maintain digital sovereignty, moving between and among marketplaces and spaces without their creations being trapped within a single platform, and with them controlling their own work, data, and context. This allows creators, consumers, and institutions of all kinds to safely interconnect and access key information in ways far simpler and more powerful than siloed systems of the past and present.

The defining product of the Onchain Era will be digital histories and identities becoming more secure, more useful, and more centralized—but also more decentralized than ever before, producing the end of Web2’s real killer app: platform lock-in. A work or piece of content minted onchain will establish a provable provenance of the origins of that information or work; distribute that work through the shared ledger of a public blockchain; store and maintain it by a decentralized network of computers and code; and allow it to be useful all around the web and our daily lives.

The drawback of the Onchain Era will be the constraints of blockchains themselves. How big can blockchains scale? How much faster can they be? How much cheaper? Will they be able to handle larger amounts of information? How complex can decentralized applications become? What comes of zk proofs? And, as always, there’s the question of onboarding.

The convenience and sovereignty of onchain systems for consumers are the killer app, not a currency someone pumps promising it might one day be worth something if everything goes right. In the Crypto Era, the point of all the noise was to increase the adoption of cryptocurrencies. In the Onchain Era, the point will be far more practical and useful: making information more durable and permanently accessible.

The Crypto Era sustained itself on a sometimes sketchy promise of future utility. The Onchain Era will create utility now and in the future.

Technological revolutions and financial capital

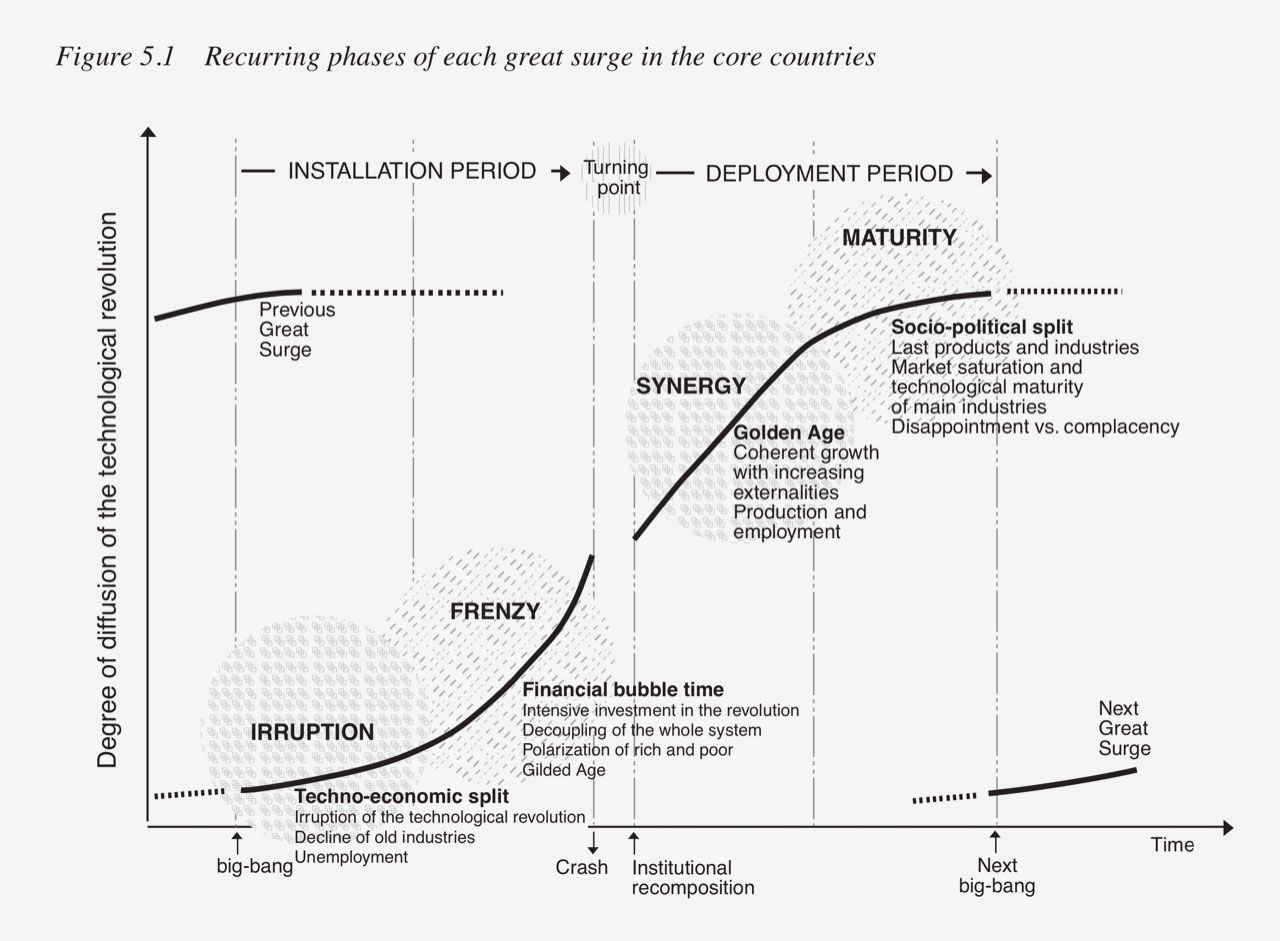

The idea that blockchain-based systems might be moving through different eras is not just a narrative device. Past technological revolutions have seen similar patterns. In Technological Revolutions and Financial Capital, British-Venezuelan economist Carlota Perez observes an important evolution in technological changes: they happen in stages, and bubbles often create later utility.

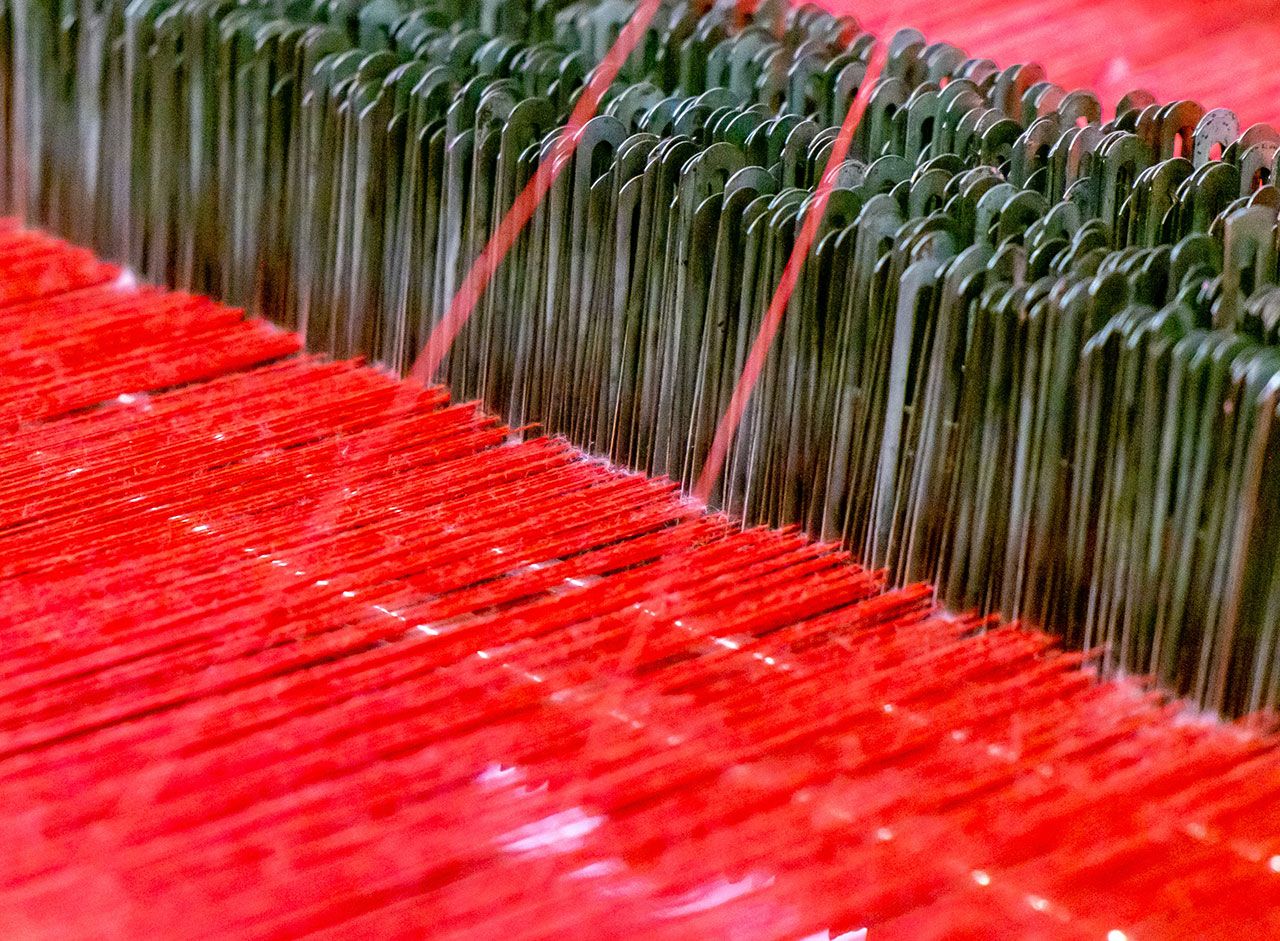

With the railroads in the 19th century, local crowdsourced investments to build regional railroad lines based on their technical potential came with promises of great riches. Those projects almost all failed, dotting the landscape with useless railroad tracks and emptying the pockets of local true believers.

What these entities eventually learned was that just building a railroad line wasn’t enough. There needed to be activity, commerce, and industry to provide support. Those things weren’t there. It was (say it with me) still early.

Perez observes that later, another generation of entrepreneurs and projects took advantage of the infrastructure built during the bubble and began using it. The core railroad infrastructure became cheap enough and the rails became plentiful enough that they offered utility. Perez finds that bubbles often create markets, just not the exact ones the initial boosters thought, and certainly not on the timelines they falsely promised.

It’s worth noting that Perez’s book was published in 2002 during the midst of the dot-com crash and before the internet’s later resurgence. The internet itself has grown in stages eerily similar to her model’s predictions.

Railroads and blockchains

So what does this mean for the end of crypto? How is a blockchain like a railroad? These are questions Odd Lots’ Joe Wiesenthal asked in a recent tweet and excellent podcast episode. His own answer listed a few things—all financial, all representative of the Crypto Era—that were not very persuasive.

Is there a railroad-like utility to blockchains? What infrastructure from the Crypto Era could actually be useful to a new era of innovation?

It’s not complicated: it’s blockchains themselves. Blockchains are invaluable and increasingly useful and usable infrastructure for holding and transferring information, assets, and ideas.

By being onchain, information gets a provable provenance that establishes its origins, its collaborators and supporters, and its context in a way that’s permanently and publicly accessible without requiring any institutional stamp of approval or maintenance. This system of independent verification and dissemination of knowledge—whether it be ideas, artwork, or personal information—is truly revolutionary. The way kids look at the internet as this magical, singular thing that contains everything isn’t far from the experience the Onchain Era will deliver.

Making information provable, infinite, and established in a shared public database sounds vaguely interesting but mostly mundane—hardly the kind of thing worth fighting culture wars over. As the Crypto Era recedes from memory and its excesses and frauds continue to be exposed, the Onchain Era, running in the background, will grow.

In Web2, posting information and ideas created content.

In the Onchain Era, posting information and ideas will create history.

Today a project I cofounded called Metalabel published a new drop that shares our vision of what creative work looks like in the Onchain Era: a new format called a record. Records are digital containers for creators to issue and sell editions of their work that can contain any creative medium (art, writing, music, performance, video, design, games, ideas, etc.) and any creative form (physical, digital, conceptual, ephemeral, live, exclusive, mass, and niche). Once purchased, records exist permanently onchain so creators never lose their work (or collection, as a supporter) should a platform go away or change hands. This, to us, is what an onchain product looks like.

We’re far from the only ones. The work Zora has done to bring culture onchain, the growth of Sound.xyz, the many creators who have already begun cataloging their work onchain, and countless other projects are all examples of a shift towards the Onchain Era.

In the future, projects like these won’t talk about crypto at all. They’ll talk about information, media, and other digital elements being secure and portable because they’re onchain. Because of this, we’ll be in more control of our digital lives. Our identities will follow us around in ways we want and not the ways Facebook and Google want. We’ll pay for these services not just with crypto, but by using credit cards and digitally native options. It won’t be perfect, but it will be more convenient compared to the labyrinths of usernames, passwords, and accounts that everyone juggles now.

In the end, this new era will have crypto to thank for getting us there. The past decade led to a giant bubble that’s now burst. It also laid a set of tracks towards a very different future.